KEALA is derived from Hawaiian origins meaning “the path” or “the way”.

We Will Show You The Way

Consultants and Advisors

Keala Advisors is a strategic business consulting and investment advisory firm that has the mission of bringing traditional management consulting and investment advisory services to the non-traditional blockchain, cryptocurrency and emerging technology space. Those who benefit the most from our mission are investors, founders, early stage companies and their service providers.

We will accomplish our mission by bridging the fundraising gap between the early stage companies whom are raising capital and the investment firms that generally do not focus on the lower level and emerging markets. The foundation of our success is found in our ability to guide entrepreneurs and early stage companies in launching and growing, sustainable companies that provide valuable products and services within the space.

TECHNOLOGY SECTORS

Blockchain

SAAS

Fintech

Privacy & Cybersecurity

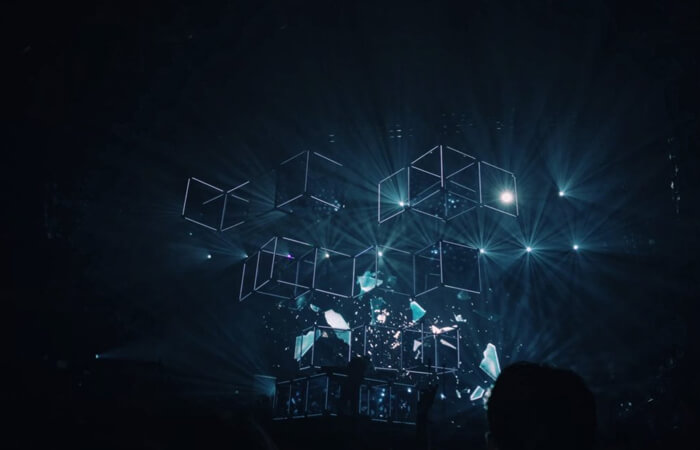

Sports & Entertainment